This Handbook is designed to give the members of the Capital Markets Roundtable for Kenya (CMRK), “the Association” a good understanding of:

This Handbook is intended to act as a guide to stakeholders of the Capital Markets and interested parties, and provides an outline of the main provisions of the Association. In preparing this Handbook, the officials of the Association have endeavored to address most possible areas of uncertainty which members may face. The Constitution of the Association clearly outlines the operational structures of the Association and is available to all members upon request. If there is any inconsistency between the Constitution and this Handbook, the provisions of the Constitution take precedence.

“The highest use of capital is not to make more money, but to make money do more for the betterment of life” Henry Ford

The Capital Markets Roundtable for Kenya (CMRK) is a non-political and a non-profit making association that primarily brings together players in the Private Markets and Real Estate Investments areas of the Capital Markets Industry to help push for reforms and bring forth innovative ideas to promote the development of a more inclusive Kenyan Capital Markets.

CMRK Membership is open to:

Capital Markets Roundtable for Kenya (CMRK)’s main objectives are as follows:

Capital Markets Roundtable for Kenya (CMRK) aims to address various challenges in the Capital Markets including, but not limited to:

Small and Medium sized businesses play a critical role in most economies, particularly in developing countries like Kenya and are important contributors to job creation and global economic development. Despite their contribution to the economy, businesses still face a myriad of challenges – with the key one being access to sustainable financing.

For a company or any other institution that is in need of money, capital markets can be used as an alternative to bank funding. Capital markets not only offer better pricing and longer maturities, but they also increase the company’s access to a wider investor base as compared to banks. Additionally, Capital markets are capable of financing riskier investment that traditionally, banks would shy away from funding, and this will significantly anchor growth of the economy.

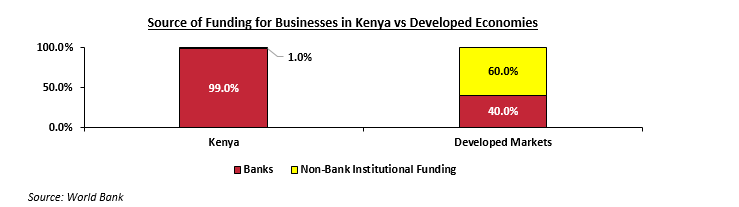

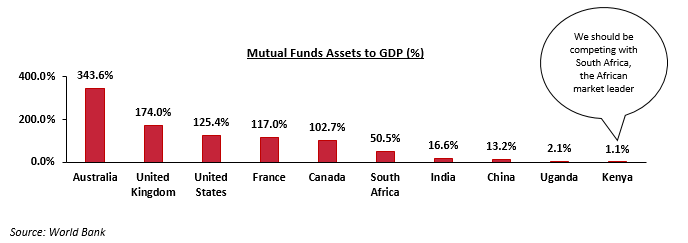

However, with all the benefits and potential that capital markets have to our economy, there has been a continued over-reliance on bank funding, with businesses relying on banks for 99.0% of their funding while a mere 1.0% of the funding comes from the capital markets, demonstrating bank dominance in Kenya. According to World Bank data, in well-functioning economies, businesses rely on banks for just 40.0% of their funding with the larger percentage, 60.0%, coming from capital markets as shown in the graph below.

Additionally, as per the Capital Markets Authority (CMA)’s Q4’2020 Capital Markets Soundness Report, the financing for construction in Kenya was majorly sourced from the banking sector at 95.0% while capital markets contributed only 5.0%; further highlighting the overreliance on banks

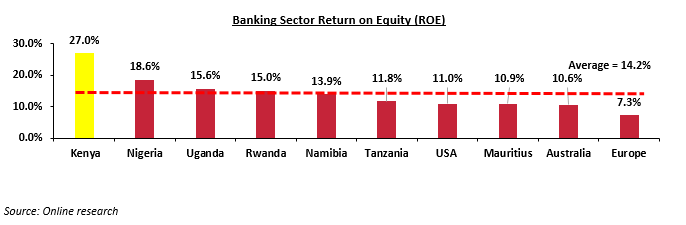

We note that the continued overreliance on banks continue to pose challenges to the common Mwananchi given the high costs of lending. This translates to higher profits for banks, with the Return on Equity (RoE) for banks in Kenya at 27.0% as of March 2023, compared to other economies in the world where the average return is 14.5%, demonstrating abnormal profits in the banking sector as a result of impediments in the capital markets:

Real estate investment is increasingly gaining preference among investors as it offers long term, stable and competitive risk-adjusted returns as compared to traditional asset classes such as equities which are highly volatile.

However, the key challenge facing the real estate sector is lack of sufficient financing as most developers rely on banks as their main source of funding, despite banks continuing to limit lending to the private sector due to increasing non- performing loans, and this has led to a number of projects stalling. This is evidenced in Central Bank of Kenya’s (CBK) Quarterly Economic Review Report July – September 2022 which highlighted that the gross loans advanced to real estate sector declined by 0.1% to Kshs 413.7 bn in Q3’2022, from Kshs 414.0 bn in Q2’2022

This points to the need to diversify sources of funding to help plug the existing housing deficit in Kenya. One way in which the capital markets can help alleviate this problem is by allowing the organic growth of private offers to fund real estate projects, void of overregulation.

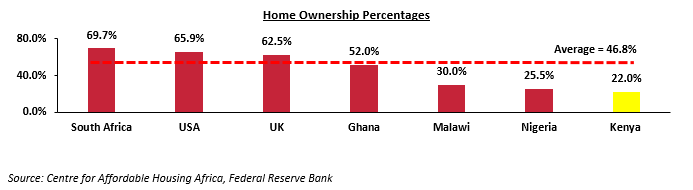

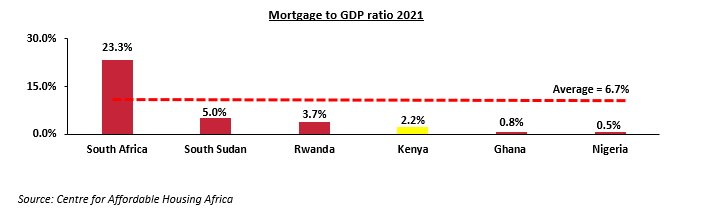

There is also insufficient funding for mortgages due to lack of a well-developed mortgage market, making our home ownership rate to be low.

Private offers are governed by the prevailing contracts between the participating parties and therefore are not regulated by a specific regulator. However, the process of offering is usually regulated so that it follows a set of defined rules and guidelines. Since they are an alternative to public markets products, they are also referred to as alternative market products. Some of the unregulated products available in the market include: Structured Products, Real Estate Notes, Commercial Paper and Private Equity.

There are numerous benefits to investing in private offers with key benefits being high returns and low correlation of returns as they have their own value that is not dependent on factors that affect traditional investments such as dwindling investor interest occasioned by volatility, and are thus able to provide real return to the investor.

Unfortunately, the growth of Private offers in the Kenyan market continues to be curtailed by the lack of regulatory support. We have seen the current Kenyan capital markets regulator continue to fight some of the active private offers in the market causing less confidence in private offers, and fueling the misconception that private offers are unsafe destination. This has limited the sources and amount of capital that businesses have access to in Kenya.

The consequence is that foreigners that are able to play in the private markets setting up businesses such as Java, Shell, Goodlife Pharmacy, Arte Caffe, Kukito, and local players are locked out of the market. All these businesses have to repatriate their investments in foreign currency, further causing depreciation of the Kenya Shilling.

It is also important to mention that many businesses are funded by private offers as shown below:

| No | Name of Private Offer | Type of Private Offer |

|---|---|---|

| 1 | Car & General Short Term Note Program | Commercial Paper |

| 2 | My Credit Note Program | Commercial Paper |

| 3 | KK Security Short Term Note Program | Commercial Paper |

| 4 | Watu Credit | Commercial Paper |

| 5 | Mogo Auto | Commercial Paper |

| 6 | ASL Credit Ltd | Commercial Paper |

| 7 | Cytonn Real Estate Notes (CREN) LLP | Real Estate Loan Note |

| 8 | Two Rivers Development Limited | Real Estate Loan Note |

| 9 | Heri Homes Capital LLP | Real Estate Loan Note |

| 10 | Britam Wealth Management Fund LLP | Structured Product |

Real Estate Investment Trusts (REITs) are regulated collective investment scheme vehicles which invest in Real Estate. REITs promoters source funds to build or acquire Real Estate assets such as residential, commercial, retail, mixed-use developments among others which they sell or rent to generate income. The income generated is then distributed to the investors as returns.

The main advantage of REITs is affordability, where by investors are able to invest in large Real Estate projects at affordable prices particularly through the security exchange platform, as opposed to purchasing an entire unit or development, which may be expensive at times. For instance, instead of purchasing a Kshs 5.0 mn 1-bedroom house in order to enjoy the relatively high real estate returns, an investor may only require Kshs 130,000 to purchase 20,000 shares of the listed ILAM Fahari I-REIT, assuming the current Kshs 6.5 per share as of 15th July 2022 and enjoy the same benefit as any real estate investor.

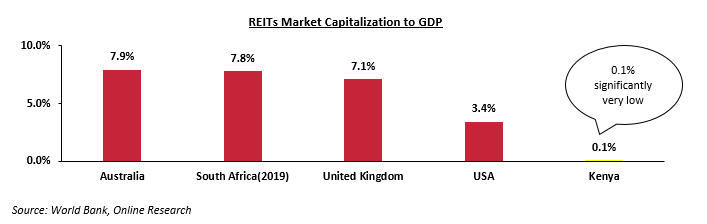

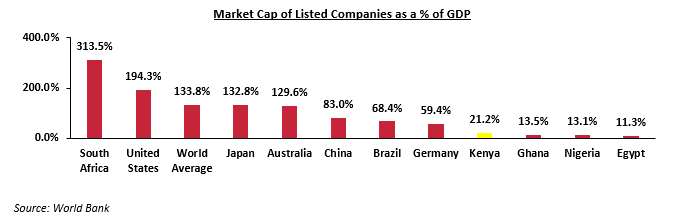

The REITs market in Kenya has continued to face numerous obstacles evidenced by the low REIT market cap to GDP at less than 0.1% compared to more developed countries such as South Africa and Australia at 7.8% and 7.9% respectively. Below is the graph of REITs Market Capitalization to GDP ratios of select countries:

The uptake of REITs in Kenya has continued to be subdued by some of the following regulatory provisions:

The REITs market in Kenya has a potential for growth with increased government support, and public sector sensitization of the REITs.

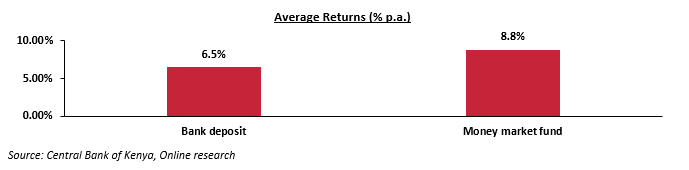

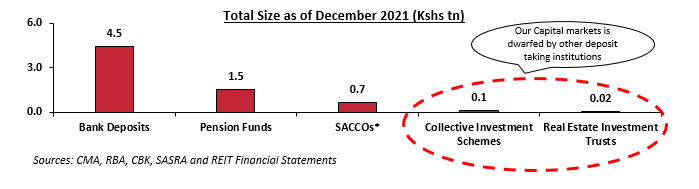

In Kenya, Banks, Collective Investment Schemes (CIS), SACCOs and other capital markets products are all competing for Kenyan depositors. Despite Unit Trust Funds, the most popular type of CIS, growing by a 5- year CAGR of 22.7% to Kshs 159.9 bn in Q3’2022, from Kshs 56.0 bn in Q3’2017, the industry is still dwarfed by asset gatherers such as bank deposits at Kshs 4.5 tn and pension industry at Kshs 1.5 tn as of the end of 2021. This is despite bank deposits offering lower returns of only 6.5% compared to money market funds which offer an average return of 8.8%, as at the end of FY’2021.

Below is a graph showing the sizes of different saving channels and capital market products in Kenya as at December 2021:

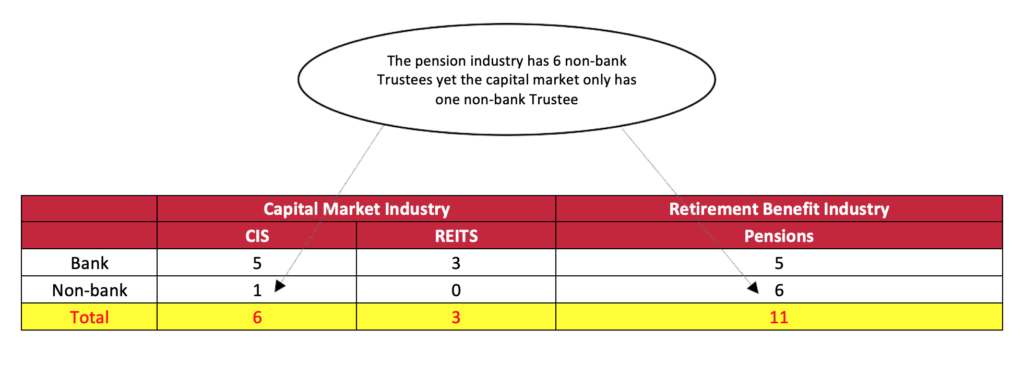

Having many diverse service providers in the financial markets allows for flexibility, increased service availability as different institutions offer different additional services, ability to cater to client preference for specific custodians, and, improved services due to the increased competition.

Unfortunately, this is not being encouraged, as currently, there only exists one non-bank trustees for mutual funds. This, again, highlights the overreliance on banks, not just for deposits and funding, but also for provision of trusteeship services. The status quo is especially unideal given that banks compete directly with the capital markets, bringing about possible conflicts of interest.

Diversifying market players will also stop Kenyans from accessing plain vanilla products, and encourage innovation in the capital markets

TThe Government of Kenya through the State Department for Housing and Urban Development is working on delivering 200,000 affordable housing units on an annual basis to ease the housing deficit in the country. The government has allocated Kshs 20.3 billion to the housing sector, with the affordable housing initiative only getting Kshs 2.7 billion in the FY’2022/2023. Assuming the cost of production for a unit is Kshs 2.0 million, then the government will only be able to deliver 1,350 units, without collaboration with Private sector players..

The private sector, on the other hand, does its part in promoting the Affordable Housing agenda by constructing affordable Real Estate units. Unfortunately, some of the ways through which the private sector may raise funding to construct these Real Estate units, such as through Real Estate Investment Trusts and private offers suffer from unsupportive capital markets policies and approaches. This has led to a disconnect between the capital markets and the national development agenda – ideally, capital markets should make it easier for government agenda to be attained.

The current Collective Investments Schemes Regulations in Kenya were formulated in 2001 and have not been updated since, despite the dynamic nature and ever-changing nature of the capital markets worldwide. This has led to the regulations lagging behind by not including provisions for private offers which have grown in importance over the years, and clear special funds guidelines to cater for the sophisticated investors’ interest in regulated alternative investments products. While there is some movement to update the regulations, the same remain in progress and are yet to be completed.

We believe that there is a need for development of relevant capital markets products that take into account previous lessons learned and are customized to address matters unique to Kenya’s markets. For example, in Kenya, Real Estate continues to play an important role in the economy contributing 8.4% to the GDP as of March 2022 and remains a popular investment option for many citizens and fund managers, due to the stable returns it delivers and low correlation with traditional investments. However, looking at the various types of capital markets products, property funds are conspicuously missing.

Currently, the CMA Act does not recognize specialized Collective Investment Schemes (CIS’s) that invest in a single asset class, or a specific sector, e.g. real estate, financial services or technology, in blatant disregard of Article 40 of the Constitution of Kenya.

We believe that more consultation with market players need to be undertaken by the markets regulator, in order to facilitate the process of developing alternative products or funds that cater for the needs of all types of investors in order to increase vibrancy and deepen the capital markets. In order to grow interest in various investment sectors in Kenya, we also need to allow those with expertise to invest in these sectors, and for the support of government agenda’s, specialized CIS’s need to be allowed with conditions that support a sector specific asset allocation.

Trustees play a critical role in the governance of CIS and other investment funds as they ensure that other service providers are performing their functions accordingly and facilitate communication with the investors. Unfortunately, the current regulatory framework seems to lean towards qualifying banking institutions as investment funds’ trustees almost exclusively.

It is therefore our belief that a more competitive and predictable trustee environment will likely lead to more innovation and better services by trustees and growth in capital markets. Our recommendation is to expand the eligibility criteria for a capital markets trustees to include any company with a minimum issued and paid-up capital of Kshs 10 million shillings, and has the sufficient and necessary financial, technical and operational resources and experience. Further, the trustee’s eligibility criteria should be included in the CMA Act and have it applied to all CMA products including REITs, CIS, and Bonds trustees, as has been done in the RBA Act, allowing for more harmony.

Under-developed capital markets makes it harder to develop pools of capital focused on projects particularly in the private markets, to complement efforts by the government. In Kenya, the main source of funding for real estate developers is banks which provide close to 95.0% of funding as compared to 40.0% in developed countries. This implies that capital markets contribute a mere 5.0% of real estate funding, compared to 60.0% in developed countries. To increase funding from capital markets, we will need to open our capital markets from the current restrictive rules and regulations, which serve to constrain capital markets development. Specifically, we need to;

The current CMA Act states that the CEO shall be appointed by the Minister and shall hold office on such terms and conditions of service as may be specified in the Act. Given the importance of the capital markets and its role in supporting the growth of the economy, we believe that the appointment should be done by the President with the approval of the Parliament, similar to how the Central Bank of Kenya (CBK)’s Governor is appointed. Additionally, the Parliamentary vetting process will promote transparency as the capital markets players, investors and Kenyans in general will be able to participate in the appointment.

CMRK believes that opening the markets and allowing for many diverse players is critical to the capital markets growth and success. In line with this, we need to allow CIS Funds to have as many custodians as is appropriate for their investors, similar to what Pensions funds have. Multiple custodians allow for flexibility, increased service availability as different banks offer different additional services, ability to cater to client preference for specific custodians, and, improved services due to the competition between the multiple custodians.

The current CIS regulations do not deal with the issue of disclosure aptly, in our view, CIS funds should be required to publish their detailed portfolio contents quarterly as global best practice. We recommend the publishing of detailed portfolio holdings by all CIS’ quarterly and the information be available to the public as well to help both investors and prospects make better informed decisions. Instances where investors have lost money in money market funds is mainly because they were not aware the funds were exposed to investments like Nakumatt Commercial paper or Chase Bank deposits.

An Investor Protection Fund, in relation to a financial market, is a fund consisting of contributions made by the market participants or financial levies by the markets regulators. Its main purpose is to ensure the protection of investors’ investments against the loss sustained or adverse impact of the breach on the person or persons claiming compensation or restitution.

The solution is to stimulate capital markets as a complementary alternative to banking markets, and hence why we believe that the intended revision of the current CIS regulations has come at an opportune time.

Expanding eligibility criteria from the current status quo where by only a few banks are eligible to be Corporate Trustees, to include any company with a minimum issued and paid up capital of Kshs 10 million shillings, and has the sufficient and necessary financial, technical and operational resources and experience, will lead to increase in the number of corporate trustees. This will in return lead to a more competitive environment that will ultimately lead to more innovations in terms of product development and better service delivery in the capital markets.

Encouraging businesses to source funds from Capital markets will reduce the overreliance of funding from banks, and foster the growth of the capital markets. Businesses will be able to obtain funding for riskier projects, which traditionally, banks would shy away from. This will not only be advantageous to Capital markets but also foster the growth of our economy by creating more job opportunities, improve infrastructure, increase housing supply and ultimately, the Capital markets will be able to help the National government meet its agenda such as the Big 4 agenda and Vision 2030

Relevant product development will allow for flexibility and increased service availability, which will increase the diversity of offerings in the capital markets that will be able to cater to the unique needs that different clients have. This will in encourage clients to invest more funds into the capital markets and also encourage business to use the capital markets as a source of fund due to the numerous channels available for them to use when seeking for funds

Having the CEO appointed by the president, with the approval of parliament, will help improve transparency given the importance of capital markets and its role in supporting the growth of the economy. Transparency will promote an optimistic outlook of the industry as the perception of un-biasness in the appointment will bring about confidence with the leadership of our capital markets

Since Kenya is a developing country, supporting the growth of private offers will help encourage and propel the saving culture as private offer gives greater returns compared to traditional saving options such as banks and SACCOs. This fund that are raised from Private offers can be used to finance some of the government agendas such as affordable housing and therefore, investors are able to assist the government is attaining its agendas.

The major barriers to growth of REITs in Kenya is the high minimum investment amount for D-REITs of Kshs 5 million and the high minimum capital requirement for Trustee of Kshs 100 million. Reducing the minimum investment amount for D-REITs will make it more affordable, given that the medium income in Kenya is Kshs 50,000. The minimum capital requirement for REITs trustees should be reduced to Kshs 10 million, the same amount that is required for pension trustees. This will see more REITs coming into the market and boost investor confidence thereby increasing the uptake for REITS.

The growth of REITs and private offers will offer investor an alternative means for financing Real estate projects, thereby help reduce the existing housing deficit and reduce overreliance on the expensive debt financing for development from banks and at the same time boost the returns to the Real Estate developers and investors. This will lead to smooth lining of the financial hiccups that some of the Real Estate projects have encountered during their development, which in some cases, have led to stalling of projects.

Joining the Capital Markets Roundtable for Kenya (CMRK) is a fast and easy process, entailing the following steps:

STEP I: Fill in the Application Form and submit it to the Association

STEP II: Pay the Entrance Fee*

STEP III: CMRK Officials consider the joining Application Form

STEP IV: Approval is granted, and CMRK officials communicate to the individual or institution of their new membership status

*CMRK is free for individuals and charges an entrance fee of Kshs 10,000.0 for institutions. It is important to note that payment of the entrance fee does not guarantee admission to the association and is subject to confirmation by the officials.

From time to time, CMRK will be seeking support from its members and external partners through fundraising drives. These activities shall be conducted by the Association’s officials following adequate due diligence procedures and with the utmost transparency.

Additionally, grants to aid the Association’s course will be welcome through both solicited and unsolicited opportunities. Full responsibility for use of these funds shall rest with the Association’s officials, who shall at all times aim to further the association’s interests and maximize all funds received. This means the officials will not be influenced by personal moral perspectives or judgements, or derive any personal benefit from funding to the Association, and, will declare any conflict of interest where it exists.

CMRK intends on pushing for various reforms from time to time on matters that align with our main agenda of primarily bringing together players in the private markets and real estate investments areas of the Capital Markets Industry. We have summarized our proposed reforms to the Capital Markets Act below, which may be subject to revision over time:

8. (1) There shall be a Chief Executive of the Authority who shall be appointed by the President with the approval of the Parliament. The Chief Executive shall, subject to this section, hold office on such terms and conditions of service as may be specified in the instrument of appointment, or otherwise from time to time.

Instead of:

8. (1) There shall be a Chief Executive of the Authority who shall be appointed by the Minister and who shall, subject to this section, hold office on such terms and conditions of service as may be specified in the instrument of appointment, or otherwise from time to time.

The CMA Act should include a section on Trustees’ eligibility in addition to what is contained in the Regulations and have it applied to all CMA products including REITs, CIS, and Bonds trustees, as has been done in the Retirement Benefits Act.

Propose an amendment of Section 18 (2B) to read:

(2B) The Cabinet Secretary shall make regulations to give effect to the provisions of Section 18(1) and subsection (2A).

Introduce a clause in Section 30x after Section 30X (ii) to read:

30X (iii). There shall be a requirement for detailed portfolio disclosures to investors in a format prescribed by The Authority.

For further information about the Association, you may contact us through the following contact details:

| Physical Address: | P.O. BOX 20695 – 00200, Nairobi |

| Phone Number: | +254 (0)724 538 660 |

| Email Address: | info@cmrkenya.com |

| Website: | www.cmrkenya.com |